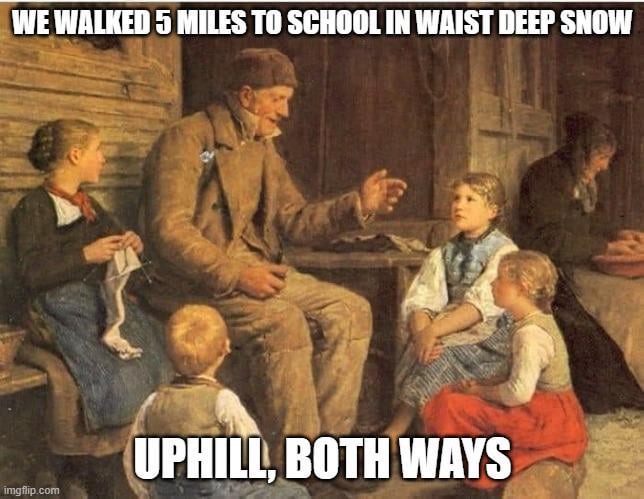

Another commonly held belief seems to be that older generations are somehow tougher than younger ones. That life was harder for them and people have gotten progressively more comfortable.

I beg to differ.

Although the tremendous sacrifices and bravery of the so-called “Greatest Generation” can never be overestimated (they literally risked everything to defeat the Nazis), I would argue that non-marginalized groups in the following generation (my parents cohort) have had it pretty good. Many went from lower class (aka poor) to highly comfortable and secure in a single lifetime. And although we benefited from our parents’ prosperity, the following generation (mine) has had it harder in many ways. And our kids are going to have it even harder.

Not to be a Debbie Downer, but there are reasons the birthrate is historically low in 2025. We all know millennials who are choosing not to have children (or GenXers & Boomers who are sad that they will never be grandparents).

I asked ChatGPT to compare the lives of someone born in the mid 1930s, mid 1960s, and mid 1990s.

Facts:

1. Income & Jobs

Born mid-1930s (entered workforce ~1950s): Median household income in 1955: ~$5,000 (≈ $58,000 in today’s dollars). A single income (often the father’s) could support a family, home, and college savings. Job security was higher; pensions were common. Born mid-1960s (entered workforce ~1980s): Median household income in 1985: ~$23,600 (≈ $66,000 today). Both parents often worked, but wages grew more slowly compared to the cost of living. 401(k)s replaced pensions, shifting retirement risk to individuals. Born mid-1990s (entered workforce ~2015–2020): Median household income in 2019: ~$68,700. In real terms, wages for young workers have stagnated since the 1970s, while housing, education, and healthcare rose sharply. Gig economy and contract jobs more common, less stability/benefits.

2. Cost of College (Public University, In-State Tuition)

1930s cohort (college in 1950s): $200/year tuition ($2,400 today). College was affordable even with part-time work; no significant debt. 1960s cohort (college in 1980s): $1,500/year tuition ($4,000–$5,000 today). Still affordable with summer jobs; modest debt possible. 1990s cohort (college in 2010s): ~$10,000/year tuition (public); $35,000–$50,000/year (private). Widespread reliance on loans; average borrower debt: $30,000+.

3. Healthcare Costs

1930s cohort: Out-of-pocket affordable; many employers covered full family insurance. Doctor visits and hospital stays far cheaper relative to income. 1960s cohort: Insurance became tied to employment. Costs rose, but still manageable. Deductibles/co-pays introduced. 1990s cohort: Healthcare costs skyrocketed (family premiums ~$24,000/year by 2025, often split with employer). Medical debt is a leading cause of bankruptcy.

4. Cost of Raising a Child (to age 18, middle-class family), not including college

1930s cohort (raising kids in 1960s): ~$25,000 total (≈ $240,000 today). 1960s cohort (raising kids in 1990s): ~$150,000 (≈ $280,000 today). 1990s cohort (raising kids in 2020s): ~$310,000. Housing, childcare, healthcare, and college costs exploded. Childcare alone can rival college tuition.

5. Retirement

1930s cohort: Retired with pensions, Social Security, mortgage-free home. Comfortable retirement was realistic for average workers. 1960s cohort: Retirement savings depended on 401(k)s and IRAs; investment risk shifted to individuals. Some still had pensions, but they were fading. 1990s cohort: Retirement is much more uncertain. Pensions rare; Social Security’s future questioned. Rising housing and healthcare costs make saving harder. Many expect to work past 65.

A final note: When my friend Carla was dying in 2022 at age 57 from brain cancer, she commented that at least she wasn’t going to have to worry about paying bills anymore. She felt that one upside of an early death would be a release from financial concerns. Carla had an advanced degree in nursing and worked (very hard) as a hospice medical director. She was married with two adult children that she’d been able to send to college.

And I’m sure she walked to school in the snow plenty of times.

![A logo for "50 Happens," [a site dedicated to Gen X women with children and grandchildren] [who embrace life's challenges with humor and resilience], [featuring a modern and uplifting design] [that embodies strength and positivity] [with an elegant and playful style] [and a harmonious blend of colors like pink, fuchsia, purple, and blue].](https://50happens.blog/wp-content/uploads/2024/12/img-5uorrxvwartomopcpuhjfjd0.png?w=300)

I agree. And we didn’t get here by accident, by some freak natural disaster. Rather, greed and poor planning. Sad.

LikeLiked by 1 person

And voting…or lack there of.

LikeLike

It’s almost as if unfettered capitalism is a bad thing.

LikeLiked by 1 person

👆

LikeLike

Wow, Mary. I burst into tears at your last paragraph. Recently I heard someone say that it’s so strange, the way people are expected to care about and work while it feels like one’s energies should be channeled into so much that is more worthy. It hit me hard. That’s the feeling. The whole blessed life force is being spent wrongly.

LikeLiked by 1 person

More worthy and necessary, I should say.

LikeLiked by 1 person

And even when doing meaningful jobs we love (as my friend did), it can feel like we’re on a hamster wheel in terms of bills

LikeLiked by 1 person

Nods. It’s also the scale. What would be enough good work to for instance stop a country from sliding backwards?

LikeLiked by 1 person

According to the financial types, the extremely low birthrate and virtual ending of new immigration is really going to F*** us (even worse) economically soon.

LikeLiked by 1 person

It’s a lot, and the warping of information makes it impossible to truly understand best approaches.

LikeLiked by 1 person

I am shocked at the cost of college tuition these days. It’s important that tuition is affordable if we want to hold on to opportunity and the American dream. My buddies went to UCLA for $750 per year (excluding student housing). They say it had the best ROI in town. AI tells me that inflation adjusted it equals $2,200 today. What a steal…

LikeLiked by 1 person

Yeah, it’s just a totally different world now. I remember some of my friends putting themselves through UMASS with part-time & summer jobs. My husband and I spent like 400K sending our two kids to college (and one of them went to a state school). We started saving aggressively when they were young. Honestly, it was rough.

LikeLiked by 1 person

It’s absolutely nuts these days. Congrats on putting them through school! It must have felt good writing that last tuition check!

LikeLiked by 1 person